Texmaco Rail Q2 2024 Earnings: Impressive Profit Surge and Strong Revenue Growth

Contents

- 1 Texmaco Rail Q2 2024 earnings

- 1.1 Texmaco Rail Q2 2024 Earnings: Impressive Profit Surge and Strong Revenue Growth

- 1.1.1 EBITDA Growth and Margin Expansion

- 1.1.2 Stock Performance and Market Impact

- 1.1.3 Volatility and Technical Indicators

- 1.1.4 Long-Term Performance

- 1.1.5 About Texmaco Rail & Engineering Ltd.

- 1.1.6 Conclusion

- 1.1.7 FAQs:

- 1.1.7.1 1.What was Texmaco Rail’s profit for Q2 2024?

- 1.1.7.2 2.How much did Texmaco Rail’s revenue grow in Q2 2024?

- 1.1.7.3 3.What is Texmaco Rail’s current EBITDA margin?

- 1.1.7.4 4.How has Texmaco Rail’s stock performed post-earnings?

- 1.1.7.5 5.What is the beta of Texmaco Rail stock?

- 1.1.7.6 6.What does the RSI indicate about Texmaco Rail’s stock?

- 1.1.7.7 7.Is Texmaco Rail trading above its moving averages?

- 1.1.7.8 8.What are Texmaco Rail’s 52-week high and low?

- 1.1.7.9 9.What sectors does Texmaco Rail serve?

- 1.1.7.10 10.How has Texmaco Rail’s stock performed in the last two years?

- 1.2 Texmaco Rail Q2 2024 earnings

- 1.3 ICICI Bank Q2 FY25 Results: Surpassing Expectations with a 14.5% Profit Jump and Robust Loan Growth

- 1.1 Texmaco Rail Q2 2024 Earnings: Impressive Profit Surge and Strong Revenue Growth

Texmaco Rail Q2 2024 earnings

Texmaco Rail Q2 2024 Earnings: Impressive Profit Surge and Strong Revenue Growth

Texmaco Rail & Engineering Ltd. delivered an impressive performance in its Q2 2024 earnings, with shares rising after the announcement. The company reported a profit of ₹74.1 crore, marking a significant increase from ₹24.6 crore in the same quarter last year. Texmaco’s revenue also climbed, experiencing a 67% jump to ₹1,346 crore from ₹805 crore year-on-year.

EBITDA Growth and Margin Expansion

Texmaco Rail’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) rose by 74%, reaching ₹132 crore compared to ₹76.2 crore in the same quarter last year. The EBITDA margin showed slight improvement, expanding to 9.8% from 9.5%. This consistent margin growth underlines the company’s operational efficiency and robust financial health.

Stock Performance and Market Impact

Following the earnings announcement, Texmaco Rail shares rose by 5.31% to ₹208.10 on the Bombay Stock Exchange (BSE). Early trading saw 0.76 lakh shares change hands, amounting to a turnover of ₹1.56 crore. The company’s market cap increased to approximately ₹8,195 crore, underscoring investor confidence in its recent performance.

The stock has shown strong price momentum over the past year, with a 52-week low of ₹120.45 on October 30, 2023, and a 52-week high of ₹296.60 on July 12, 2024. This range reflects both strong investor interest and a degree of volatility in trading.

Volatility and Technical Indicators

Texmaco Rail shares have a beta of 1.7, indicating high volatility over the past year. The Relative Strength Index (RSI) currently stands at 43.9, suggesting that the stock is trading in a balanced zone—neither overbought nor oversold.

The stock is trading above its 5-day, 10-day, 20-day, and 30-day moving averages, but remains below its 50-day, 100-day, and 200-day moving averages. This mixed technical setup may indicate some investor caution in the short term, even as longer-term gains remain strong.

Long-Term Performance

Over the past two years, Texmaco Rail’s stock price has surged by 339.49%, and in the last three years, it has delivered a remarkable 535% gain. This long-term growth highlights the company’s consistent performance and appeal among investors seeking high returns in the railway engineering sector.

About Texmaco Rail & Engineering Ltd.

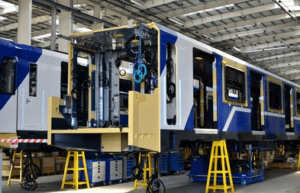

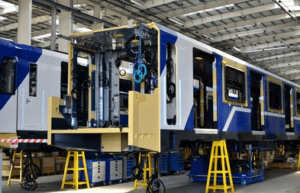

Texmaco Rail & Engineering is a leader in railway infrastructure manufacturing. The company produces a wide range of products, including railway freight cars, hydro-mechanical equipment, and structural components. It also supplies locomotive parts, steel girders for bridges, steel castings, and pressure vessels. Texmaco’s engineering, procurement, and construction (EPC) contracts support railway track construction, signaling, telecommunication, rail electrification, and automated fare collection systems. This diversification enables Texmaco Rail to serve various facets of the railway and engineering industry.

Conclusion

Texmaco Rail & Engineering’s Q2 2024 results underscore a stellar performance, with significant growth in profit and revenue and a steady expansion of its EBITDA margin. While short-term volatility remains a factor, the company’s strong fundamentals and extensive product portfolio position it well for continued growth. Investors may find Texmaco Rail’s long-term potential appealing, given its sustained upward trend and commitment to innovation in railway engineering.

FAQs:

1.What was Texmaco Rail’s profit for Q2 2024?

A. The company reported a profit of ₹74.1 crore in Q2 2024.

2.How much did Texmaco Rail’s revenue grow in Q2 2024?

A. Revenue grew by 67%, reaching ₹1,346 crore.

3.What is Texmaco Rail’s current EBITDA margin?

A. The EBITDA margin expanded to 9.8% in Q2 2024.

4.How has Texmaco Rail’s stock performed post-earnings?

A. Shares rose 5.31% to ₹208.10 on the BSE after the earnings report.

5.What is the beta of Texmaco Rail stock?

A. Texmaco Rail’s stock has a beta of 1.7, indicating high volatility.

6.What does the RSI indicate about Texmaco Rail’s stock?

A. With an RSI of 43.9, the stock is neither overbought nor oversold.

7.Is Texmaco Rail trading above its moving averages?

A. It’s trading above its 5-, 10-, 20-, and 30-day moving averages but below its 50-, 100-, and 200-day moving averages.

8.What are Texmaco Rail’s 52-week high and low?

A. The 52-week high is ₹296.60, and the low is ₹120.45.

9.What sectors does Texmaco Rail serve?

A. Texmaco Rail serves railway infrastructure, freight cars, EPC contracts, and more.

10.How has Texmaco Rail’s stock performed in the last two years?

A. The stock has surged by 339.49% over the past two years.

Texmaco Rail Q2 2024 earnings

ICICI Bank Q2 FY25 Results: Surpassing Expectations with a 14.5% Profit Jump and Robust Loan Growth

1 comment