Understanding the Risk/Reward Ratio in Mutual Funds

Contents

- 1 Risk/Reward Ratio

- 1.1 Understanding the Risk/Reward Ratio in Mutual Funds

- 1.2 What is the Risk/Reward Ratio in Mutual Funds?

- 1.3 Why is the Risk/Reward Ratio Important in Mutual Funds?

- 1.4 Components of Risk in Mutual Funds

- 1.5 Advantages of Understanding the Risk/Reward Ratio in Mutual Funds

- 1.6 Disadvantages of Focusing Solely on the Risk/Reward Ratio

- 1.7 Examples of Risk/Reward Ratios in Mutual Funds

- 1.8 Conclusion

- 1.9 FAQs

- 1.9.1 1. What is a good risk/reward ratio in mutual funds?

- 1.9.2 2. Can the risk/reward ratio predict future performance?

- 1.9.3 3. How can I lower the risk in my mutual fund investments?

- 1.9.4 4. Are higher-risk mutual funds always better for long-term growth?

- 1.9.5 5. How often should I review my mutual fund portfolio?

- 1.10 Risk/Reward Ratio

- 1.11 RBI Monetary Policy: 5 Key Highlights from RBI MPC Outcome on Policy Rates, Inflation & Growth Forecast

Risk/Reward Ratio

Understanding the Risk/Reward Ratio in Mutual Funds

Investing in mutual funds is one of the most popular methods for growing wealth over time. Mutual funds offer diversification, professional management, and accessibility for investors of all levels. However, like any investment, mutual funds come with risks. To maximize potential returns while minimizing losses, understanding the risk/reward ratio is essential. This concept helps investors balance risk and reward, ensuring they make informed decisions based on their financial goals and risk tolerance.

In this article, we will dive deep into the risk/reward ratio in mutual funds, explaining what it is, why it matters, and how investors can apply it to their portfolio. We will also explore its advantages, disadvantages, and provide real-world examples for better understanding.

What is the Risk/Reward Ratio in Mutual Funds?

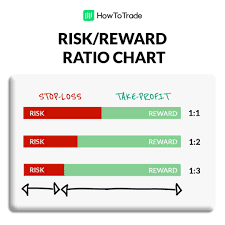

The risk/reward ratio is a measure used by investors to evaluate the potential return of an investment relative to the risk involved. In simple terms, it quantifies how much risk an investor is willing to take on in exchange for a certain level of return. This ratio is crucial because every investment carries some degree of risk, and understanding this balance can help investors make more calculated decisions.

In the context of mutual funds, the risk/reward ratio is used to assess the potential gains a mutual fund can generate compared to the level of risk the investor is exposed to. Mutual funds can vary significantly in their risk levels based on their underlying assets, such as stocks, bonds, or a combination of both. By understanding this ratio, investors can better align their portfolios with their financial objectives and risk tolerance.

Formula for Risk/Reward Ratio

The risk/reward ratio can be calculated using the following formula:

Risk/Reward Ratio=Potential LossPotential Gain\text{Risk/Reward Ratio} = \frac{\text{Potential Loss}}{\text{Potential Gain}}=Potential GainPotential Loss

For instance, if an investor is considering a mutual fund investment with a potential loss of 10% and a potential gain of 20%, the risk/reward ratio would be:

Risk/Reward Ratio=1020=0.5\text{Risk/Reward Ratio} = \frac{10}{20} = 0.5=2010=0.5

This means that for every 1 unit of risk, the investor stands to gain 2 units of reward. A lower risk/reward ratio is often considered more favorable, as it implies the potential reward outweighs the risk.

Why is the Risk/Reward Ratio Important in Mutual Funds?

Mutual funds are designed to offer a balance of risk and reward based on the investor’s goals and risk tolerance. However, not all mutual funds are created equal, and their risk profiles can vary widely. Understanding the risk/reward ratio helps investors make informed decisions by weighing potential returns against the risks involved.

- Informed Decision-Making: By calculating the risk/reward ratio, investors can assess whether the potential return of a mutual fund justifies the level of risk they are exposed to. This is especially important when comparing different types of mutual funds, such as equity funds, bond funds, or balanced funds.

- Risk Management: Knowing the risk/reward ratio allows investors to manage risk more effectively. A higher risk/reward ratio may be suitable for aggressive investors with a high-risk tolerance, while conservative investors may prefer a lower ratio.

- Goal Alignment: Investors have different financial goals, whether it’s saving for retirement, a house, or funding a child’s education. Understanding the risk/reward ratio ensures that the selected mutual funds align with these goals and the investor’s timeline.

Components of Risk in Mutual Funds

Several factors contribute to the risk associated with mutual funds. Here are the most common risk components that investors should be aware of:

1. Market Risk

Also known as systematic risk, market risk is the possibility that the value of the investments in the mutual fund will decline due to changes in the overall market. Factors like economic downturns, political instability, or natural disasters can lead to market volatility, affecting the value of mutual funds, especially those heavily invested in equities.

Example: In the 2008 global financial crisis, mutual funds invested in stocks experienced significant losses as the stock market plummeted.

2. Interest Rate Risk

Interest rate risk is particularly relevant to bond mutual funds. It refers to the risk that the value of bonds within the fund will decrease due to rising interest rates. When interest rates rise, bond prices typically fall, and vice versa.

Example: If a bond mutual fund holds long-term bonds and interest rates rise, the value of those bonds will likely decrease, resulting in a negative impact on the fund’s overall value.

3. Credit Risk

Credit risk is the possibility that the issuer of a bond within a mutual fund will default on its payment obligations. This risk is higher for funds that invest in lower-rated bonds (also known as junk bonds).

Example: A high-yield bond mutual fund may offer attractive returns, but it carries a higher credit risk due to its investments in bonds from companies with lower credit ratings.

4. Liquidity Risk

Liquidity risk occurs when a mutual fund is unable to sell its investments quickly enough to meet redemption requests from investors. This is more common in funds that invest in less liquid assets, such as real estate or small-cap stocks.

Example: During market downturns, a real estate mutual fund may struggle to sell properties at a fair price, leading to losses for investors trying to exit the fund.

5. Inflation Risk

Inflation risk is the possibility that the returns from a mutual fund will not keep pace with inflation, eroding the purchasing power of the investor’s money. This risk is more prevalent in funds that offer lower returns, such as bond or money market funds.

Example: If a bond mutual fund generates an annual return of 3% while inflation is at 4%, the real return for the investor is negative (-1%).

Advantages of Understanding the Risk/Reward Ratio in Mutual Funds

1. Better Investment Decisions

By understanding the risk/reward ratio, investors can make more informed decisions about where to allocate their money. For instance, an investor with a low-risk tolerance may choose a mutual fund with a lower risk/reward ratio, ensuring that the potential losses are minimized, even if it means slightly lower returns.

2. Portfolio Diversification

Mutual funds allow for diversification, and understanding the risk/reward ratio helps investors balance high-risk and low-risk investments in their portfolio. This diversification reduces the overall risk while allowing for potential rewards across different asset classes.

3. Aligns with Financial Goals

Investors have different financial objectives, whether saving for retirement or seeking short-term gains. Understanding the risk/reward ratio ensures that mutual fund choices align with these goals. For example, a young investor saving for retirement in 30 years may tolerate more risk compared to an investor approaching retirement in five years.

4. Risk Management

Understanding the risk/reward ratio helps investors actively manage their risk exposure. They can adjust their portfolio based on changing market conditions, personal circumstances, or shifts in financial goals. This flexibility ensures long-term financial success.

Disadvantages of Focusing Solely on the Risk/Reward Ratio

1. Over-Simplification of Complex Investments

While the risk/reward ratio provides valuable insights, it oversimplifies the complexity of mutual funds. Factors such as market conditions, economic outlook, and fund manager performance can significantly impact the actual outcomes. Relying solely on this ratio may lead to incomplete assessments.

2. Doesn’t Account for External Factors

The risk/reward ratio does not consider external factors like tax implications, fees, or changes in interest rates. A mutual fund may have an attractive risk/reward ratio, but hidden fees or taxes could reduce overall returns.

Example: A mutual fund with a 10% return might appear attractive, but if management fees and taxes consume 3%, the real return is reduced to 7%.

3. Past Performance is Not Indicative of Future Results

The risk/reward ratio is often calculated based on past performance, which may not always reflect future outcomes. Market conditions can change unexpectedly, rendering the calculated ratio less reliable in predicting future returns.

Example: A mutual fund that performed well during a bull market may have a favorable risk/reward ratio, but during a bear market, the same fund could suffer significant losses.

Examples of Risk/Reward Ratios in Mutual Funds

1. Equity Mutual Funds

Equity mutual funds invest primarily in stocks, making them one of the higher-risk mutual fund categories. However, they also offer higher potential returns. The risk/reward ratio for equity mutual funds is typically higher, meaning investors are exposed to more risk but can also expect greater rewards over the long term.

Example: An equity mutual fund focused on technology stocks may have a risk/reward ratio of 0.6, indicating that for every $1 of risk, the potential reward is $1.67.

2. Bond Mutual Funds

Bond mutual funds are considered lower-risk investments compared to equity funds, but they also offer lower returns. The risk/reward ratio for bond funds tends to be lower, making them more suitable for conservative investors seeking steady, predictable returns.

Example: A government bond mutual fund might have a risk/reward ratio of 0.3, meaning that for every $1 of risk, the potential reward is $3.33.

3. Balanced Mutual Funds

Balanced mutual funds invest in a mix of stocks and bonds, providing a moderate level of risk and reward. The risk/reward ratio for balanced funds is typically in the middle range, making them suitable for investors with a moderate risk tolerance.

Example: A balanced mutual fund may have a risk/reward ratio of 0.4, indicating that for every $1 of risk, the potential reward is $2.50.

Conclusion

Understanding the risk/reward ratio in mutual funds is essential for making informed investment decisions. This ratio provides a clear picture of the potential return relative to the risk involved, helping investors align their portfolios with their financial goals and risk tolerance. While the risk/reward ratio is a valuable tool, it should be used in conjunction with other factors such as market conditions, fund performance, and external costs like taxes and fees.

By carefully analyzing the risk/reward ratio, investors can strike the right balance between risk and reward, optimizing their portfolios for long-term success. Whether you’re a conservative investor seeking stability or an aggressive investor chasing high returns, understanding this ratio will enable you to navigate the world of mutual funds with confidence.

FAQs

1. What is a good risk/reward ratio in mutual funds?

A good risk/reward ratio depends on your investment goals and risk tolerance. Typically, a ratio of 0.5 or lower is considered favorable, meaning the potential reward is greater than the risk.

2. Can the risk/reward ratio predict future performance?

No, the risk/reward ratio is based on past performance and does not guarantee future results. It should be used as one tool among many in evaluating mutual funds.

3. How can I lower the risk in my mutual fund investments?

You can lower the risk by diversifying your portfolio, investing in lower-risk mutual funds (like bond funds), and considering the time horizon for your financial goals.

4. Are higher-risk mutual funds always better for long-term growth?

Higher-risk funds can offer greater potential returns, but they also come with the possibility of significant losses. It’s essential to balance your risk tolerance with your long-term growth objectives.

5. How often should I review my mutual fund portfolio?

It’s recommended to review your portfolio at least annually, but more frequent reviews (quarterly or semi-annually) may be beneficial, especially during volatile market periods.

Risk/Reward Ratio

RBI Monetary Policy: 5 Key Highlights from RBI MPC Outcome on Policy Rates, Inflation & Growth Forecast

1 comment