KRN Heat Exchanger IPO Details: Price Band, Lot Size & Key Information

Contents

KRN Heat Exchanger IPO

KRN Heat Exchanger IPO Details: Price Band, Lot Size & Key Information

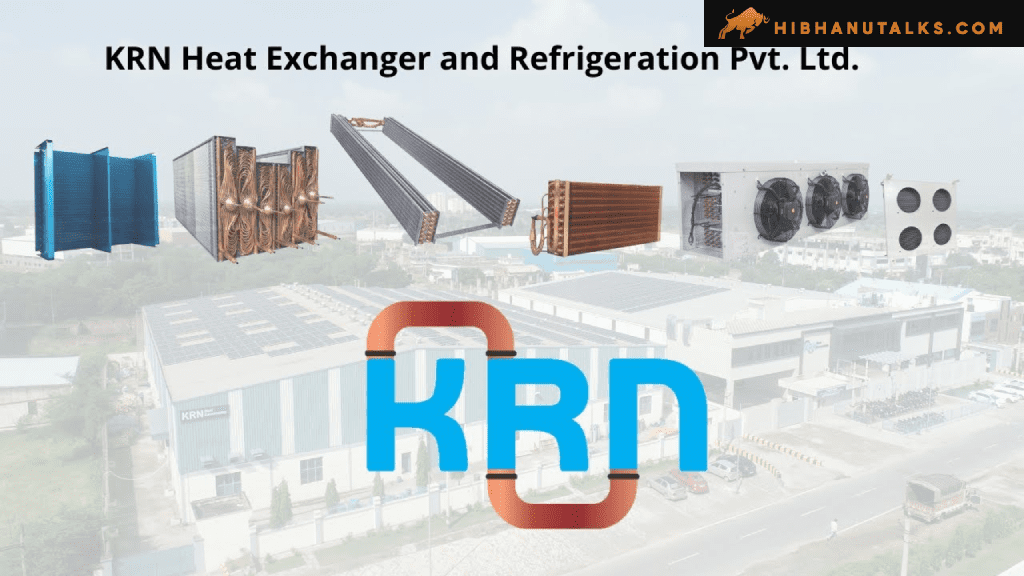

KRN Heat Exchanger and Refrigeration is a well-established manufacturer of fin and tube-type heat exchangers. The company specializes in producing a variety of copper and aluminum fins and tubes, water coils, condenser coils, and evaporator coils. These products are widely used in the HVAC&R (Heating, Ventilation, Air Conditioning, and Refrigeration) industry, with operations centered at their manufacturing facility in Neemrana, Rajasthan.

The company has announced its Initial Public Offering (IPO), opening on September 25, 2024, and closing on September 27, 2024. Key details about the IPO are outlined below:

Key Details:

- Price Band: The IPO price band is set between ₹209-₹220 per share.

- Lot Size: The minimum investment will be for 65 shares and multiples thereof.

- IPO Size: The company aims to raise ₹341 crore through the sale of 1.55 crore equity shares.

- No Offer for Sale (OFS): The entire issue comprises fresh shares, with no secondary sale from existing shareholders.

- Anchor Investor Bidding: Bidding for anchor investors will take place on September 24, 2024.

- Pre-IPO Placement: KRN Heat Exchanger raised ₹9.54 crore through a pre-IPO placement round, with 4.77 lakh shares sold at ₹200 per share to individual investors.

- Use of Funds: The proceeds from the IPO will be used to invest in the company’s wholly-owned subsidiary (KRN HVAC Products) for setting up a new manufacturing facility in Neemrana, Alwar, Rajasthan.

- Major Clients: The company has long-standing relationships with key industry players such as Daikin Air Conditioning India Pvt Ltd, Blue Star, Kirloskar Chillers Pvt Ltd, Schneider Electric IT Business India Pvt Ltd, and Climaventa Climate Technologies.

Advantages of KRN Heat Exchanger IPO:

- Market Demand: KRN operates in the growing HVAC&R sector, where the demand for heat exchangers is expected to remain strong, especially in residential and industrial cooling solutions.

- Established Client Base: With clients like Daikin, Blue Star, and Schneider Electric, the company benefits from steady business relationships with well-known brands.

- Strong Promoter Holding: The company’s promoters, including Santosh Kumar Yadav, Anju Devi, and Manohar Lal, hold 94.39% of the company pre-IPO, showing strong confidence in the company’s growth potential.

- Diversified Product Range: The company manufactures a variety of heat exchangers with different sizes and materials, catering to a broad spectrum of applications in domestic, commercial, and industrial environments.

- Expansion Plans: The funds raised through the IPO will be used for setting up a new manufacturing facility, which positions the company for future growth.

Disadvantages of KRN Heat Exchanger IPO:

- Concentration Risk: A significant portion of the company’s revenue may be dependent on a few major clients. Any disruption in these relationships could impact the company’s performance.

- Competitive Industry: The HVAC&R industry is highly competitive, and KRN faces competition from both domestic and international players.

- Capital Intensive: The business of manufacturing heat exchangers is capital intensive, which could lead to high costs, especially in the initial phases of expanding manufacturing facilities.

- Potential Volatility: As with any IPO, there could be short-term volatility in the stock price due to market conditions or investor sentiment.

Conclusion

KRN Heat Exchanger and Refrigeration’s IPO offers investors an opportunity to participate in a growing company with a strong foothold in the HVAC&R industry. The company’s established client base, coupled with its expansion plans, makes it a promising prospect. However, investors should also consider the competitive landscape and capital-intensive nature of the business. With the funds raised from the IPO being directed toward capacity expansion, the company is well-positioned to capitalize on future market demand.

FAQs

- What is the price band for the KRN Heat Exchanger IPO? The price band for the IPO is set at ₹209-₹220 per share.

- When will the KRN Heat Exchanger IPO open and close? The IPO will open on September 25, 2024, and close on September 27, 2024.

- What is the lot size for the IPO? The lot size for the KRN Heat Exchanger IPO is 65 shares, meaning investors need to buy at least 65 shares.

- How much money does KRN Heat Exchanger plan to raise? The company aims to raise ₹341 crore through the IPO.

- What is the purpose of raising funds through the IPO? The funds will be used for investment in KRN HVAC Products, a subsidiary, for setting up a new manufacturing facility in Neemrana, Alwar, Rajasthan.

- Who are KRN Heat Exchanger’s major clients? Some of the major clients include Daikin Air Conditioning India Pvt Ltd, Blue Star, Schneider Electric, Kirloskar Chillers, and Climaventa Climate Technologies.

- What is the company’s business focus? KRN Heat Exchanger manufactures a range of heat exchangers, primarily for the HVAC&R industry, serving both domestic and industrial clients.

KRN Heat Exchanger IPO

Motisons Jewellers Announces 1:10 Stock Split – Record Date & Key Details

1 comment