The FIRE Movement: Financial Independence, Retire Early Explained

Contents

- 1 financial independence retire early

- 1.1 The FIRE Movement: Financial Independence, Retire Early Explained

- 1.2 Introduction

- 1.3 Understanding Financial Independence

- 1.4 The Principles of the FIRE Movement

- 1.5 Different Types of FIRE

- 1.6 Steps to Achieve Financial Independence and Retire Early

- 1.7 Common Challenges and How to Overcome Them

- 1.8 Real-Life Examples of FIRE Success Stories

- 1.9 The Role of Passive Income in Achieving FIRE

- 1.10 The Importance of Financial Literacy

- 1.11 Conclusion

- 1.12 FAQs

- 1.13 financial independence retire early

- 1.14 Financial Independence: A Detailed Guide to Achieving Financial Freedom

financial independence retire early

The FIRE Movement: Financial Independence, Retire Early Explained

Introduction

The concept of early retirement is no longer just a dream for the ultra-rich. Thanks to the FIRE (Financial Independence, Retire Early) movement, many people are finding ways to retire decades earlier than traditional timelines suggest. But what exactly is the FIRE movement, and how can you achieve it? This comprehensive guide will walk you through everything you need to know about achieving financial independence and retiring early.

What is the FIRE Movement?

The FIRE movement is a financial lifestyle that aims to achieve early retirement through diligent saving, investing, and frugal living. The core idea is to accumulate enough wealth so that investment returns can cover living expenses, eliminating the need for traditional employment.

Why is the FIRE Movement Popular?

The FIRE movement appeals to those who desire more freedom and control over their lives. By achieving financial independence, individuals can pursue passions, spend more time with family, or travel the world without being tied to a 9-to-5 job.

Understanding Financial Independence

Before you can retire early, you need to achieve financial independence. But what does that entail?

Defining Financial Independence

Financial independence means having enough income to cover your living expenses without relying on active employment. This income typically comes from investments, savings, or passive income sources.

Calculating Your FI Number

Your FI (Financial Independence) number is the amount of money you need to save to sustain your lifestyle without working. A common method to calculate this is by multiplying your annual expenses by 25. This figure assumes a 4% safe withdrawal rate from your investments.

The Principles of the FIRE Movement

To successfully achieve FIRE, you need to adopt certain principles and lifestyle changes.

Frugality and Mindful Spending

Frugality is a cornerstone of the FIRE movement. This doesn’t mean living cheaply but rather spending mindfully and cutting unnecessary expenses. It’s about maximizing value and prioritizing what truly matters to you.

Aggressive Saving

Saving a significant portion of your income is crucial. Many FIRE adherents save 50% or more of their income. This accelerated savings rate shortens the time needed to accumulate enough wealth for early retirement.

Investing Wisely

Investing is key to growing your wealth. By putting your savings into assets that appreciate over time, like stocks or real estate, you can benefit from compound interest and grow your net worth more rapidly.

Different Types of FIRE

The FIRE movement isn’t one-size-fits-all. There are different variations depending on your goals and lifestyle preferences.

Lean FIRE

Lean FIRE involves living a minimalist lifestyle with lower expenses. It requires less wealth to achieve financial independence but often involves significant lifestyle sacrifices.

Fat FIRE

Fat FIRE is for those who want to maintain a higher standard of living. It requires more savings but allows for more comfort and luxury in early retirement.

Barista FIRE

Barista FIRE is a hybrid approach where individuals achieve partial financial independence but still work part-time jobs. This reduces the total amount needed for savings while providing some additional income.

Coast FIRE

Coast FIRE means you’ve saved enough early on that you no longer need to contribute to retirement savings. Your existing investments will grow over time, allowing you to eventually retire without additional savings.

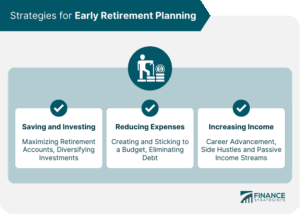

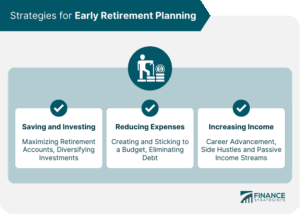

Steps to Achieve Financial Independence and Retire Early

Achieving FIRE involves a combination of strategic planning, disciplined saving, and smart investing. Here’s a step-by-step guide to get you started.

1. Assess Your Financial Situation

Start by evaluating your current financial status. Calculate your net worth by subtracting your liabilities from your assets. This will give you a clear picture of where you stand and how far you need to go.

2. Set Clear Financial Goals

Determine your FI number and set a timeline for achieving it. Having specific, measurable goals will keep you motivated and on track.

3. Create a Budget and Stick to It

Develop a budget that aligns with your financial goals. Track your expenses and identify areas where you can cut back. Sticking to a budget is essential for maximizing your savings rate.

4. Increase Your Income

Look for ways to boost your income. This could involve asking for a raise, starting a side hustle, or investing in education to advance your career. The more you earn, the more you can save and invest.

5. Save Aggressively

Aim to save at least 50% of your income. Automate your savings to ensure consistency and reduce the temptation to spend.

6. Invest Wisely

Put your savings to work by investing in a diversified portfolio of stocks, bonds, and real estate. Consider low-cost index funds and ETFs for long-term growth. The power of compound interest will significantly accelerate your path to financial independence.

7. Monitor and Adjust Your Plan

Regularly review your progress and adjust your plan as needed. Life circumstances can change, and your financial plan should be flexible enough to adapt.

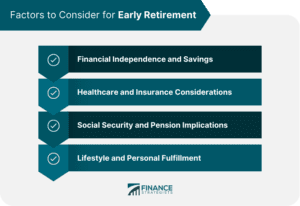

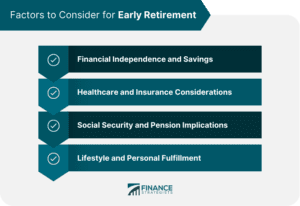

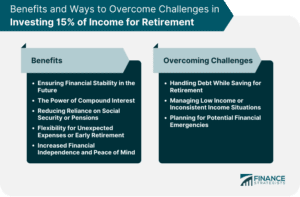

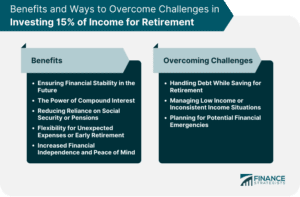

Common Challenges and How to Overcome Them

Achieving FIRE isn’t without its challenges. Here are some common obstacles and strategies to overcome them.

Lifestyle Inflation

As your income increases, it’s tempting to upgrade your lifestyle. Resist the urge to spend more and instead funnel additional income into savings and investments.

Market Volatility

Market downturns can impact your investment returns. Stay the course and avoid panic selling. Maintain a diversified portfolio to mitigate risks.

Social Pressure

Living a frugal lifestyle can lead to social pressure from friends and family. Stay focused on your goals and remember why you’re pursuing FIRE.

Healthcare Costs

Healthcare can be a significant expense, especially in retirement. Research your options for health insurance and consider setting up a Health Savings Account (HSA) to cover future medical expenses.

Real-Life Examples of FIRE Success Stories

Hearing about others’ successes can be incredibly motivating. Here are a few real-life examples of individuals who achieved FIRE.

Mr. Money Mustache

Mr. Money Mustache, a popular personal finance blogger, retired in his early 30s by living frugally and saving a large portion of his income. He shares his journey and tips on his blog, inspiring many to pursue FIRE.

The Mad Fientist

The Mad Fientist, another influential figure in the FIRE community, retired at 34. He focuses on tax optimization and efficient investing strategies to achieve financial independence.

Our Next Life

Tanja Hester and her husband, the creators of the blog “Our Next Life,” retired in their 30s. They emphasize the importance of aligning your financial goals with your values and passions.

The Role of Passive Income in Achieving FIRE

Passive income is a critical component of the FIRE strategy. Here’s how to build and maximize passive income streams.

Dividend Investing

Investing in dividend-paying stocks can provide a steady stream of passive income. Reinvesting dividends can accelerate your wealth accumulation.

Real Estate Investments

Owning rental properties can generate consistent rental income. Real estate investments also offer the potential for property value appreciation.

Online Businesses

Creating online businesses, such as blogs, e-commerce stores, or digital products, can generate passive income with relatively low initial investment.

Royalties and Licensing

If you have creative talents, consider earning royalties from books, music, or other intellectual property. Licensing your creations can provide ongoing income with little additional effort.

The Importance of Financial Literacy

Financial literacy is crucial for achieving and maintaining financial independence. Here’s how to enhance your financial knowledge.

Read Personal Finance Books

Books like “Your Money or Your Life” by Vicki Robin and Joe Dominguez and “The Simple Path to Wealth” by JL Collins offer valuable insights into managing money and investing.

Follow Personal Finance Blogs and Podcasts

Staying updated with blogs and podcasts can provide continuous learning and inspiration. Some popular ones include “The Financial Independence Podcast” and “Afford Anything.”

Take Financial Courses

Consider enrolling in online courses on personal finance and investing. Websites like Coursera and Udemy offer courses that can deepen your understanding of financial principles.

Join Financial Independence Communities

Engage with online forums and communities focused on FIRE. Platforms like Reddit’s r/financialindependence and the Mr. Money Mustache forums offer support and knowledge sharing.

Conclusion

The FIRE movement offers a pathway to financial freedom and early retirement, allowing you to live life on your own terms. By embracing frugality, saving aggressively, and investing wisely, you can achieve financial independence and retire years, if not decades, ahead of the traditional timeline. Remember, the journey to FIRE requires dedication, discipline, and patience. But the rewards—freedom, flexibility, and peace of mind—are well worth the effort.

FAQs

1. How long does it take to achieve FIRE?

The time it takes to achieve FIRE varies depending on your income, savings rate, and investment returns. Some achieve it in as little as 10 years, while others may take 20 or more. Consistency and strategic planning are key.

2. Can anyone achieve FIRE?

While FIRE is accessible to many, it may be more challenging for those with lower incomes or higher expenses. However, with determination and careful planning, most people can significantly improve their financial situation.

3. What if I achieve FIRE and then decide I want to work again?

Achieving FIRE gives you the freedom to choose. If you find you miss work or want to pursue new opportunities, you have the flexibility to do so without financial pressure.

4. Do I need to cut out all luxuries to achieve FIRE?

Not necessarily. The goal is to prioritize spending on what truly matters to you and cut back on unnecessary expenses. Finding a balance that allows you to enjoy life while saving aggressively is key.

5. How do I stay motivated on the path to FIRE?

Setting clear goals, tracking your progress, and celebrating milestones can keep you motivated. Engaging with the FIRE community for support and inspiration can also help.

1 comment