Dollar-Cost Averaging in Mutual Funds: A Comprehensive Guide

Contents

Dollar-Cost Averaging

Dollar-Cost Averaging in Mutual Funds:A Comprehensive Guide

Introduction

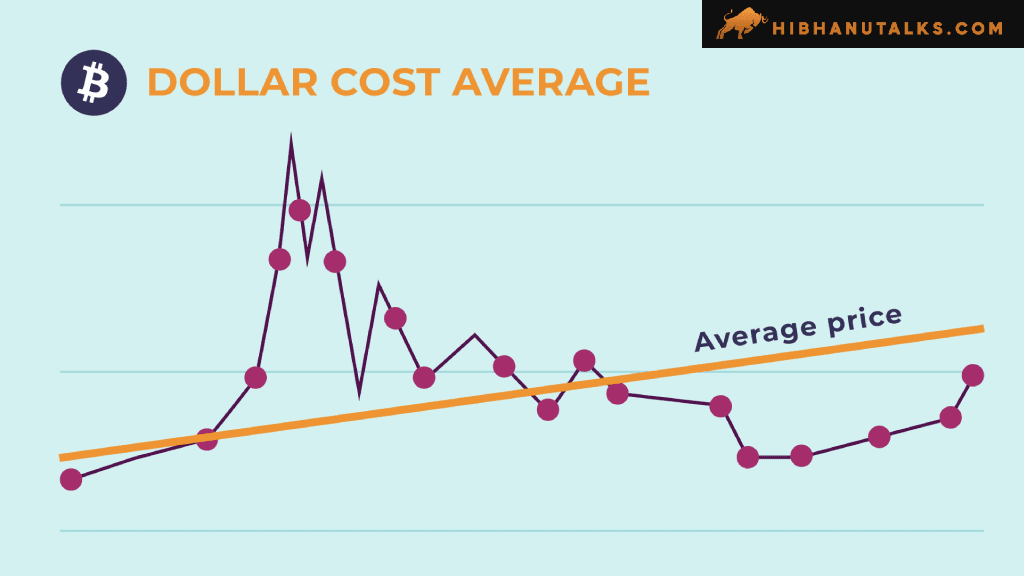

Dollar-Cost Averaging (DCA) is a well-known investment strategy that can help investors manage risk, especially in volatile markets. It’s a method often used by individuals investing in mutual funds, as it allows them to spread their investment over time, rather than investing a lump sum all at once. But how does Dollar-Cost Averaging work in mutual funds, and what are its pros and cons?

In this comprehensive guide, we will explore Dollar-Cost Averaging, how it applies to mutual funds, and its advantages and disadvantages. We’ll also provide examples and insights for investors looking to maximize the benefits of this strategy.

What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging (DCA) is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This method allows investors to purchase more shares when prices are low and fewer shares when prices are high, effectively reducing the average cost per share over time.

How DCA Works in Mutual Funds

When applied to mutual funds, Dollar-Cost Averaging involves regularly purchasing shares of a mutual fund at set intervals—whether it’s weekly, monthly, or quarterly. Since mutual funds are composed of various stocks and bonds, DCA helps investors mitigate market volatility and the risk of poor timing when entering the market.

For example, if an investor decides to invest $500 per month in a mutual fund, they continue to invest that amount regardless of whether the market is performing well or poorly. By doing so, the investor can smooth out the volatility and avoid trying to time the market—something notoriously difficult to do successfully.

Why Use Dollar-Cost Averaging in Mutual Funds?

Dollar-Cost Averaging can be particularly beneficial when investing in mutual funds, which are often composed of a diverse range of assets. DCA allows investors to build their positions gradually, making it easier to weather market ups and downs.

Benefits for Beginners

DCA is especially useful for beginners who might not have a large sum of money to invest upfront. Instead of trying to predict the perfect time to invest, beginners can start with smaller amounts and increase their investments over time.

Reduces Emotional Investing

One of the most significant advantages of DCA is that it reduces the emotional component of investing. Many investors get caught up in market fluctuations, buying when the market is high out of excitement or selling when the market is low due to fear. DCA enforces discipline by removing the need for market timing, reducing the temptation to make emotional decisions.

Advantages of Dollar-Cost Averaging in Mutual Funds

Now that we understand the concept, let’s explore the specific advantages of using Dollar-Cost Averaging when investing in mutual funds.

- Reduces the Risk of Poor Timing

Timing the stock market is notoriously tricky, and even professional investors struggle with it. DCA removes the need for investors to “guess” when the best time to invest is. By spreading out purchases over time, you mitigate the risk of buying all your shares at a market peak. This method provides a buffer against price volatility, smoothing out fluctuations in the market.

Example:

Suppose you decide to invest $12,000 into a mutual fund. Instead of investing the entire amount at once, you break it into 12 monthly installments of $1,000. In months when the market is down, you’ll be able to buy more shares for $1,000, and in months when the market is up, you’ll buy fewer shares. This way, your average cost per share will be lower than if you invested the lump sum all at once.

- Encourages Consistent Investment

One of the biggest advantages of DCA is the consistency it encourages. Rather than worrying about market conditions, investors can set up automatic contributions, ensuring that they continue to invest regularly. This is especially helpful for long-term goals like retirement savings.

Example:

An investor might choose to allocate a set percentage of their monthly paycheck toward mutual fund investments. Over the long run, this ensures that the investor remains committed to their financial goals, even during market downturns.

- Mitigates the Effects of Volatility

Market volatility can lead to significant price fluctuations. DCA helps investors take advantage of this by buying more shares when prices are low and fewer shares when prices are high. This process helps reduce the average cost per share over time.

Example:

Let’s say a mutual fund’s share price fluctuates over several months—$10 in January, $12 in February, $9 in March, and $11 in April. By consistently investing $100 each month, an investor ends up with more shares in months when prices are low, ultimately reducing the overall cost per share.

- Simplifies Investment Decisions

DCA simplifies the decision-making process for investors, particularly those who are unsure about market timing. Investors no longer need to worry about whether the market is at a high or low point. Instead, they stick to their regular investment schedule, letting the strategy handle the rest.

Disadvantages of Dollar-Cost Averaging in Mutual Funds

While Dollar-Cost Averaging offers many advantages, it is not without drawbacks. Understanding the potential downsides is critical to making an informed decision about whether this strategy is right for you.

- Misses Out on Large Gains in Bull Markets

One of the key criticisms of DCA is that it may prevent investors from taking full advantage of bull markets. In a rapidly rising market, a lump-sum investment would yield higher returns compared to spreading investments out over time.

Example:

Imagine a mutual fund that sees a sharp increase in share price over a short period. An investor who uses DCA would only benefit incrementally from this growth, whereas a lump-sum investor would see their entire investment grow with the market.

- Higher Transaction Costs

For investors who pay transaction fees on their mutual fund purchases, DCA could lead to higher overall costs. If you’re making regular investments, each one might incur a fee, which can add up over time.

Example:

If your mutual fund charges a $5 fee per transaction and you invest monthly, you’ll pay $60 in transaction fees over the course of a year. A lump-sum investment would only incur a single $5 fee, potentially saving you money.

- Not Ideal for All Asset Classes

DCA works best in volatile markets where prices fluctuate. However, if you’re investing in an asset class that experiences minimal price changes, the benefits of DCA may be less significant. In such cases, a lump-sum investment might yield better results.

Example:

If you’re investing in a bond mutual fund, which tends to have more stable prices compared to equities, DCA may not offer significant advantages. A lump-sum investment in such a scenario may be more effective.

Dollar-Cost Averaging vs. Lump-Sum Investing

A common question among investors is whether Dollar-Cost Averaging is better than lump-sum investing. The answer depends on various factors, including market conditions, personal risk tolerance, and investment goals.

Market Conditions

In a volatile or declining market, Dollar-Cost Averaging offers a significant advantage by reducing the average cost per share. In a strong bull market, however, lump-sum investing may yield better returns, as the entire investment benefits from price appreciation.

Risk Tolerance

Investors with a lower tolerance for risk may prefer DCA because it spreads out the investment and reduces exposure to short-term market fluctuations. Conversely, those with a higher risk tolerance might opt for lump-sum investing to maximize potential returns.

Long-Term Goals

For long-term investments like retirement savings, DCA can be a prudent strategy. It ensures consistent investment and can reduce the emotional impact of market volatility.

How to Implement Dollar-Cost Averaging in Mutual Funds

Implementing Dollar-Cost Averaging in mutual funds is straightforward, but there are a few steps you should take to ensure success:

- Choose a Reputable Mutual Fund

Start by selecting a mutual fund that aligns with your investment goals. Consider factors like the fund’s performance history, management team, and fees.

- Set a Regular Investment Amount

Determine how much you can comfortably invest at regular intervals. This could be a set dollar amount each month or a percentage of your income.

- Automate Your Investments

To make DCA easier, set up automatic contributions to your mutual fund. Most brokerages and mutual fund companies allow you to automate the process, ensuring consistent investment over time.

- Review Your Strategy Periodically

While DCA is a long-term strategy, it’s important to review your investments periodically to ensure they’re still aligned with your financial goals. If your circumstances change, you may need to adjust your investment amounts or frequency.

Conclusion

Dollar-Cost Averaging is a tried-and-true investment strategy that can benefit both novice and experienced investors alike. By spreading investments over time, DCA reduces the risk of poor timing, mitigates the impact of market volatility, and simplifies the investment process.

While it may not be ideal for all market conditions—particularly in a strong bull market—DCA offers a disciplined, consistent approach to investing, especially in mutual funds. For long-term investors focused on building wealth steadily and managing risk, Dollar-Cost Averaging is a strategy worth considering.

FAQs

- Is Dollar-Cost Averaging a good strategy for beginners?

Yes, Dollar-Cost Averaging is an excellent strategy for beginners because it simplifies the investment process and reduces the risk of emotional decision-making. It also allows new investors to start with smaller amounts and gradually build their investments over time.

- Can I use Dollar-Cost Averaging with any type of mutual fund?

Yes, DCA can be used with any type of mutual fund, whether it’s a stock, bond, or balanced fund. However, it is most effective in volatile markets where prices fluctuate regularly.

- How long should I use Dollar-Cost Averaging?

There’s no set time frame for using DCA. Many investors use it as a long-term strategy, especially for retirement savings. However, you can adjust your approach based on changes in market conditions or personal financial goals.

- Does Dollar-Cost Averaging guarantee profits?

No, Dollar-Cost Averaging doesn’t guarantee profits. It helps reduce risk and manage volatility, but like all investment strategies, it comes with risks. It’s essential to invest in quality funds and have a long-term perspective.

- What are the key disadvantages of Dollar-Cost Averaging?

The primary disadvantages are that it may result in higher transaction costs and that it could miss out on significant gains in a rising market. Additionally, it may not be as effective for asset classes with minimal price fluctuations, like bonds.

1 comment