Azad Engineering’s $82.89 Million Deal with Mitsubishi: A Game-Changer for Turbine Technology?

Contents

- 1 Azad engineering share price

- 1.1 Azad Engineering’s $82.89 Million Deal with Mitsubishi: A Game-Changer for Turbine Technology?

- 1.1.1 Azad Engineering’s Expanding Global Reach

- 1.1.2 Growth in Core Markets

- 1.1.3 Manufacturing Capabilities and Market Position

- 1.1.4 Stock Performance Since 2023 IPO

- 1.1.5 Conclusion

- 1.1.6 FAQs:

- 1.1.6.1 1.What is the value of Azad Engineering’s contract with Mitsubishi Heavy Industries?

- 1.1.6.2 2.What will Azad Engineering supply under this Mitsubishi contract?

- 1.1.6.3 3.How does Azad Engineering’s contract with Mitsubishi benefit its business?

- 1.1.6.4 4.What was Azad Engineering’s recent contract with Honeywell Aerospace about?

- 1.1.6.5 5.What percentage of Azad’s revenue comes from exports?

- 1.1.6.6 6.How has Azad Engineering’s stock performed since its IPO?

- 1.1.6.7 7.What are Azad Engineering’s primary sectors of operation?

- 1.1.6.8 8.What is the revenue breakdown for Azad’s Energy and Aerospace sectors?

- 1.1.6.9 9.How many manufacturing facilities does Azad Engineering have?

- 1.1.6.10 10.What growth rate has ICICI Securities projected for Azad Engineering?

- 1.2 Azad engineering share price

- 1.3 New Indian Railway Ticket Booking Rules: Major Changes Effective November 1, 2024

- 1.1 Azad Engineering’s $82.89 Million Deal with Mitsubishi: A Game-Changer for Turbine Technology?

Azad Engineering’s $82.89 Million Deal with Mitsubishi: A Game-Changer for Turbine Technology?

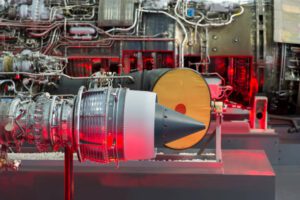

Hyderabad-based Azad Engineering Ltd. has announced a significant win—a long-term contract and price agreement (LTCPA) with Japan’s Mitsubishi Heavy Industries Ltd. This deal is centered around the supply of highly engineered rotating and stationary airfoils, essential components for advanced gas and thermal power turbine engines used in Mitsubishi’s global power generation projects. Valued at $82.89 million (approximately ₹700 crore), this contract will be fulfilled over the next five years, marking a major milestone for Azad Engineering as it expands its presence in the power generation industry.

Azad Engineering’s Expanding Global Reach

The deal with Mitsubishi comes on the heels of a recent order from Honeywell Aerospace Ltd. in October, valued at ₹134 crore. This contract involves manufacturing complex components tailored to meet the surging demand in the aviation industry. These high-value partnerships reinforce Azad Engineering’s commitment to supplying advanced components across both the energy and aerospace sectors, further solidifying its reputation in international markets.

Growth in Core Markets

As of the June quarter, Azad Engineering’s revenue distribution demonstrates a strong focus on exports, with 91% of its sales originating from overseas clients. The Energy and Oil & Gas sector forms the backbone of its business, accounting for 78.4% of the topline, while Aerospace & Defence makes up 18.5%. This strategic export focus has enabled Azad to maintain steady revenue growth while also capturing key opportunities in the high-demand power generation and aerospace industries.

Manufacturing Capabilities and Market Position

With four state-of-the-art manufacturing facilities spread across 20,000 square meters in Hyderabad, Azad Engineering is well-equipped to meet the complex production requirements of clients like Mitsubishi and Honeywell. Despite its rapid growth, ICICI Securities noted in a recent report that Azad’s market share remains relatively modest. The brokerage estimates that even with a 25%-30% growth rate until 2035, Azad’s market share will reach approximately 7% in the energy sector, 2% in Aerospace & Defence, and just under 4% in Oil & Gas. Nevertheless, this trajectory positions Azad favorably as it scales up operations and continues to deliver for its international client base.

Stock Performance Since 2023 IPO

Azad Engineering’s recent stock performance has been impressive. Having debuted in 2023 at an IPO price of ₹524, the stock has nearly tripled, closing Friday’s Mahurat Trading session at ₹1,463.65. This price surge reflects investor confidence in Azad’s growth potential and its expanding portfolio of high-value contracts within the global energy and aerospace sectors.

Conclusion

Azad Engineering Ltd. is establishing itself as a key player in the global power generation and aerospace sectors through high-stakes partnerships and a strategic focus on international markets. The recent LTCPA with Mitsubishi Heavy Industries signals Azad’s commitment to delivering complex, high-performance components for advanced turbine technology. As Azad continues to expand its global reach, its robust manufacturing capabilities and impressive stock performance demonstrate a strong upward trajectory.

FAQs:

1.What is the value of Azad Engineering’s contract with Mitsubishi Heavy Industries?

A. The contract is valued at $82.89 million (around ₹700 crore), to be executed over five years.

2.What will Azad Engineering supply under this Mitsubishi contract?

A. Azad will supply rotating and stationary airfoils for gas and thermal power turbine engines.

3.How does Azad Engineering’s contract with Mitsubishi benefit its business?

A. This contract boosts Azad’s presence in the global power generation market and strengthens its export-driven growth.

4.What was Azad Engineering’s recent contract with Honeywell Aerospace about?

A. In October, Azad received a ₹134 crore order from Honeywell to produce complex aviation components.

5.What percentage of Azad’s revenue comes from exports?

A. Approximately 91% of Azad’s sales are from overseas markets, as of the June quarter.

6.How has Azad Engineering’s stock performed since its IPO?

A. Azad’s stock has nearly tripled from its IPO price of ₹524 to ₹1,463.65 as of the latest Mahurat Trading session.

7.What are Azad Engineering’s primary sectors of operation?

A. Azad operates mainly in Energy, Oil & Gas, and Aerospace & Defence sectors.

8.What is the revenue breakdown for Azad’s Energy and Aerospace sectors?

A. Energy and Oil & Gas contribute 78.4%, while Aerospace & Defence accounts for 18.5% of revenue.

9.How many manufacturing facilities does Azad Engineering have?

A. Azad operates four manufacturing facilities in Hyderabad, covering 20,000 square meters.

10.What growth rate has ICICI Securities projected for Azad Engineering?

A. ICICI Securities projects a 25%-30% growth rate for Azad Engineering until FY 2035.

New Indian Railway Ticket Booking Rules: Major Changes Effective November 1, 2024

1 comment