KRN Heat Exchanger Shares List at 118% Premium Over IPO Price: Market Debut at ₹480 on NSE

Contents

KRN Heat Exchanger stock price

KRN Heat Exchanger shares made a remarkable debut in the stock market, listing at a significant premium over its Initial Public Offering (IPO) price. Here’s a detailed breakdown of the listing event, the company’s plans, and its business operations:

- Listing Details

- NSE Listing: KRN Heat Exchanger shares were listed on the NSE on October 3, 2024, at ₹480 per share, marking a 118.18% premium over the IPO price of ₹220.

- BSE Listing: On the BSE, the shares opened at ₹470, representing a 113.6% premium over the IPO price.

- Grey Market Performance: Prior to the official listing, KRN Heat Exchanger shares commanded a premium of ₹220 in the grey market, exceeding expectations upon listing.

- IPO Overview

- IPO Size: The company’s IPO raised ₹342 crore. Shares were offered at a price range between ₹209 and ₹220.

- Subscription Rate: The IPO was oversubscribed by 213.26 times, largely driven by institutional investor participation, showing high confidence in the company’s potential.

- Anchor Investors: Before the public subscription, KRN Heat Exchanger had already secured ₹100 crore from anchor investors.

- Use of IPO Proceeds

- New Manufacturing Facility: The company plans to invest ₹242.5 crore into its subsidiary, KRN HVAC Products, for establishing a new manufacturing facility in Neemrana, Alwar, Rajasthan.

- General Corporate Purposes: The remaining funds from the IPO will be used for general corporate purposes, such as working capital needs and operational enhancements.

- Company Background

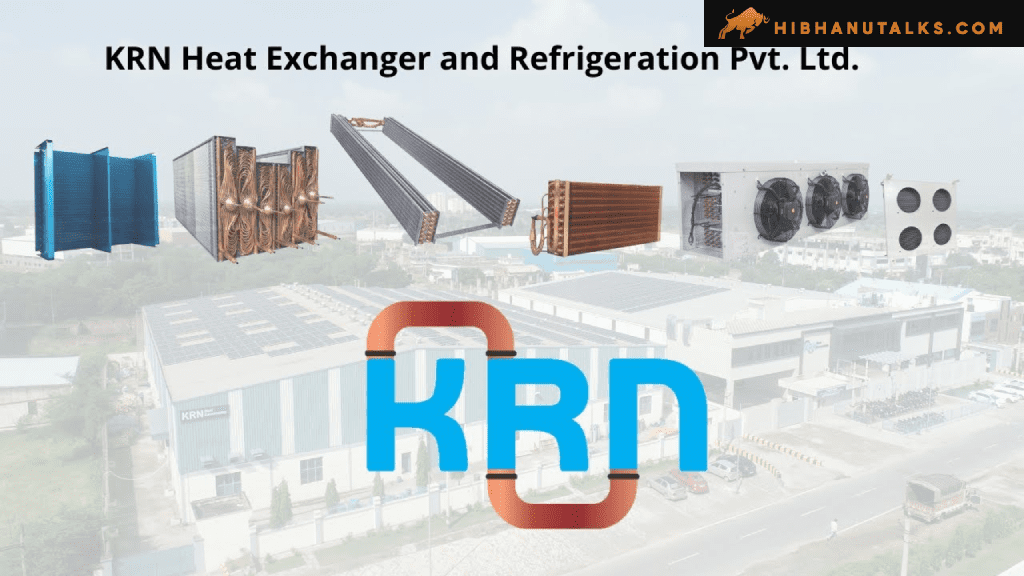

- Business Operations: KRN Heat Exchanger primarily manufactures fin and tube-type heat exchangers catering to the HVAC&R (Heating, Ventilation, Air Conditioning, and Refrigeration) industry.

- Location: All manufacturing operations are centralized in the RIICO Industrial Area, Neemrana, Rajasthan, where the company operates out of two industrial plots.

Advantages of KRN Heat Exchanger Shares Listing

- High Listing Premium: With shares listing at over 118% premium, early investors realized substantial returns on their IPO investment, demonstrating strong market demand.

- Strong Investor Confidence: The overwhelming 213.26 times subscription shows significant institutional interest, indicating positive expectations regarding the company’s growth and profitability.

- Expansion Plans: Investment in a new manufacturing facility in Neemrana reflects a strategic approach to scaling production, which could lead to greater market share and enhanced revenue generation.

- Grey Market Signals: The stock’s premium in the grey market (₹220 per share) indicated high investor interest even before listing, which was surpassed upon official debut.

Disadvantages of KRN Heat Exchanger Shares Listing

- Overvaluation Concerns: A 118% premium on listing may raise concerns of overvaluation, leading to potential market correction if the company doesn’t perform as per market expectations.

- Volatility Post-listing: Stocks that debut at a significant premium can experience sharp price swings in the short term, resulting in volatility that may deter risk-averse investors.

- Limited Liquidity: High oversubscription from institutional investors could mean limited availability of shares for retail investors, which might drive speculative trading and price instability.

Conclusion

The stellar debut of KRN Heat Exchanger shares highlights strong market confidence in the company. With a solid 118.18% premium over its IPO price and high subscription rates, the company has captured significant attention in the HVAC&R industry. Its future prospects look bright, especially with planned expansion into a new manufacturing facility. However, investors should remain cautious of potential short-term volatility, given the rapid price appreciation at the listing.

FAQs

- What was the listing price of KRN Heat Exchanger shares on NSE?

KRN Heat Exchanger shares listed at ₹480 per share on NSE, marking a 118.18% premium over the IPO price. - What was the IPO price range for KRN Heat Exchanger shares?

The IPO price range was ₹209-₹220 per share. - How many times was the IPO oversubscribed?

The IPO was oversubscribed 213.26 times, largely due to institutional investor participation. - What is the company planning to do with the funds raised from the IPO?

The company plans to invest ₹242.5 crore into its subsidiary, KRN HVAC Products, to set up a new manufacturing facility in Neemrana, Rajasthan. The remaining funds will be used for general corporate purposes. - What does KRN Heat Exchanger manufacture?

KRN Heat Exchanger manufactures fin and tube-type heat exchangers for the HVAC&R industry. - Where are KRN Heat Exchanger’s manufacturing operations located?

The company’s operations are located in RIICO Industrial Area, Neemrana, Rajasthan, across two industrial plots.

KRN Heat Exchanger stock price

Mankind Pharma’s $1.6 Billion Acquisition of Bharat Serums Approved by India’s Anti-Trust Regulator

1 comment