Gautam Adani Pips Ambani as India’s Richest; SRK Enters Billionaire List

Contents

India’s richest person

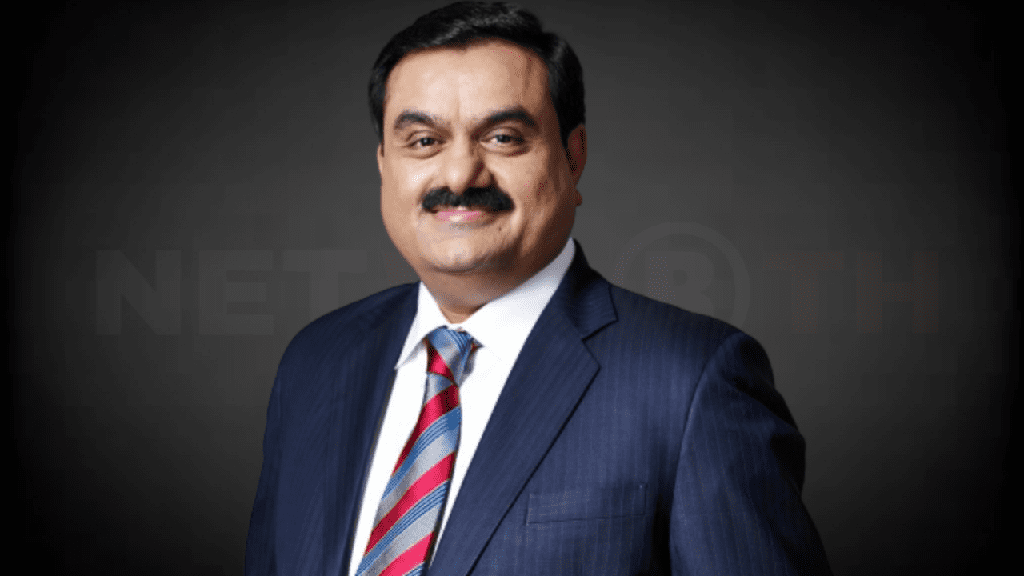

Gautam Adani Pips Ambani as India’s Richest; SRK Enters Billionaire List

In 2024, Gautam Adani and his family have emerged as the richest individuals in India, according to the Hurun India Rich List. Their wealth surged by 95%, reaching ₹1,161,800 crores. This significant increase in wealth has placed them at the top of the list, overtaking Mukesh Ambani, who now holds the second position with a wealth of ₹1,014,700 crores.

- Record-Breaking Rich List: The 2024 Hurun India Rich List has set new records by featuring a total of 1,539 individuals with a net worth exceeding ₹1,000 crores. This is the first time the list has surpassed the 1,500 mark, highlighting the substantial rise in wealth among India’s elite.

- Adani’s Wealth Growth: Gautam Adani’s rise to the top of the list is attributed to a dramatic 95% increase in his wealth. This growth has been driven by the substantial appreciation of Adani Group shares, particularly in sectors like ports and energy. Notably, Adani Ports saw a 98% increase in share price, and Adani’s energy-focused companies experienced an average growth of 76%.

- Major Players in the Top 10: The top five individuals on the 2024 list are:

- 1st: Gautam Adani & Family – ₹1,161,800 crores

- 2nd: Mukesh Ambani – ₹1,014,700 crores

- 3rd: Shiv Nadar & Family (HCL Technologies) – ₹314,000 crores

- 4th: Cyrus S. Poonawalla & Family (Serum Institute of India) – ₹240,000 crores

- 5th: Dilip Shanghvi (Sun Pharmaceutical Industries) – ₹220,000 crores

- Long-Term Top Performers: Over the past five years, six individuals have consistently remained in the top ten of the list. These include Gautam Adani, Mukesh Ambani, Shiv Nadar, Cyrus S. Poonawalla, Gopichand Hinduja, and Radhakishan Damani.

- Adani Group’s Market Performance: The significant wealth increase for Gautam Adani is closely linked to the performance of Adani Group companies. The rise in share prices of Adani Ports and various energy-focused companies has been a major driver of the wealth surge. The decision by MSCI to lift restrictions on Adani Group securities has also contributed to a stabilizing outlook for key stocks like Adani Enterprises, Adani Ports, and Ambuja Cements.

Advantages of Adani’s Wealth Surge

- Enhanced Investment Capabilities:

- Increased wealth provides Gautam Adani and his family with greater capacity to invest in diverse sectors, further expanding the Adani Group’s business interests.

- Market Influence:

- With significant wealth and market presence, Adani can exert considerable influence over market trends and investment decisions, potentially shaping industry developments.

- Economic Contributions:

- The growth of Adani Group contributes to the Indian economy by creating jobs, developing infrastructure, and supporting various sectors like energy and ports.

- Global Presence:

- The rise in wealth and market valuation enhances Adani Group’s global standing, attracting international investments and partnerships.

Disadvantages of Adani’s Wealth Surge

- Regulatory Scrutiny:

- The rapid increase in wealth and market influence may attract increased regulatory scrutiny and potential investigations, especially concerning market practices and share price manipulation.

- Market Volatility:

- High levels of wealth and market concentration can lead to increased volatility, especially if there are fluctuations in Adani Group’s stock prices.

- Public Perception:

- The significant wealth gap between Adani and other billionaires, including Mukesh Ambani, might raise concerns about wealth inequality and the concentration of economic power.

- Operational Risks:

- Rapid expansion and high-profile investments increase operational risks, including the potential for management challenges and integration issues across diverse business segments.

Conclusion

Gautam Adani’s rise to the top of the Hurun India Rich List reflects a remarkable surge in wealth, driven by the strong performance of Adani Group’s share prices and strategic investments. This achievement underscores the growing influence of Adani in the Indian and global markets. However, it also brings challenges such as regulatory scrutiny and market volatility that need to be managed carefully.

FAQs

Q1: How did Gautam Adani become the richest person in India?

- Gautam Adani’s wealth surged by 95% due to significant increases in the share prices of Adani Group companies, particularly in sectors like ports and energy.

Q2: What factors contributed to Adani’s wealth increase?

- The rise in share prices of Adani Ports and energy-focused companies, along with MSCI lifting restrictions on Adani Group securities, contributed to Adani’s wealth increase.

Q3: What does the 2024 Hurun India Rich List reveal about wealth in India?

- The list highlights a substantial increase in wealth among India’s elite, with a record 1,539 individuals each having a net worth over ₹1,000 crores.

Q4: What are the potential risks associated with Adani’s increased wealth?

- Potential risks include regulatory scrutiny, market volatility, public perception issues, and operational challenges due to rapid expansion.

Q5: Who are the other top wealthiest individuals in India for 2024?

- Other top individuals include Mukesh Ambani, Shiv Nadar, Cyrus S. Poonawalla, and Dilip Shanghvi.

1 comment