The Psychology Behind Stock Market Movements: Understanding Investor Behavior

Contents

- 1 Psychology of stock market

- 1.1 The Psychology Behind Stock Market Movements: Understanding Investor Behavior

- 1.2 Impact on the Market:

- 1.3 Impact on the Market:

- 1.4 Impact on the Market:

- 1.5 Impact on the Market:

- 1.6 Recency Bias

- 1.7 Impact on the Market

- 1.8 Psychology of stock market

- 1.9 Strategic Excellence Drives Glenmark Pharmaceuticals’ Q1 FY25 Earnings Surge

Psychology of stock market

The Psychology Behind Stock Market Movements: Understanding Investor Behavior

Introduction

The stock market is often perceived as a battleground of numbers, charts, and financial data. However, beneath the surface, the market is profoundly influenced by human emotions and psychology. Understanding the psychological factors driving stock market movements can provide investors with valuable insights into market trends, helping them make informed decisions. In this article, we will explore the psychology behind stock market movements, discuss key psychological biases, and examine the advantages and disadvantages of understanding these psychological factors with real-world examples.

Understanding the Role of Psychology in the Stock Market

The Intersection of Psychology and Finance

Psychology plays a critical role in finance, particularly in the stock market. While financial models and economic indicators provide a rational framework for understanding the market, human behavior often deviates from these models due to emotional and psychological factors. This intersection of psychology and finance is known as behavioral finance, a field that studies the effects of psychological influences on investors and the subsequent impact on markets.

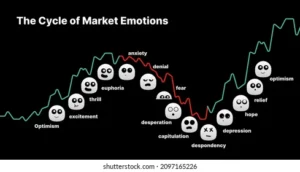

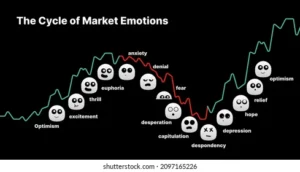

Investor Sentiment: The Driving Force

Investor sentiment refers to the overall mood or attitude of investors toward the market or a particular stock. Sentiment can range from extreme optimism (bullish) to extreme pessimism (bearish). These collective emotions significantly influence stock prices, sometimes leading to market movements that are not justified by fundamental factors. For example, during a bull market, positive sentiment can drive prices higher, even if the underlying economic data does not support such optimism.

The Impact of Fear and Greed

Fear and greed are two of the most powerful emotions that drive stock market movements. Greed can lead to overconfidence and excessive risk-taking, pushing prices to unsustainable levels. On the other hand, fear can result in panic selling, causing sharp declines in stock prices. Understanding how these emotions influence investor behavior is crucial for navigating the stock market.

Key Psychological Biases That Influence Stock Market Movements

Herd Behavior

Definition: Herd behavior occurs when investors follow the actions of the majority, rather than making independent decisions based on their analysis.

Example: During the dot-com bubble of the late 1990s, many investors bought tech stocks simply because everyone else was doing it, leading to inflated prices and eventual market collapse.

Impact on the Market: Herd behavior can lead to market bubbles and crashes, as the collective actions of investors drive prices away from their intrinsic values.

Advantage: Understanding herd behavior can help investors identify and avoid market bubbles.

Disadvantage: It can be challenging to resist the pressure to follow the crowd, especially during extreme market conditions.

Confirmation Bias

Definition: Confirmation bias is the tendency to seek out information that confirms one’s existing beliefs while ignoring contradictory evidence.

Example: An investor who believes in the long-term success of a particular stock may only focus on positive news about the company, disregarding any negative reports.

Impact on the Market:

Confirmation bias can lead to distorted decision-making and increased market volatility as investors reinforce their preconceptions without considering all available information.

Advantage: Being aware of confirmation bias can lead to more balanced and informed investment decisions.

Disadvantage: Overcoming confirmation bias requires a conscious effort to seek out and consider opposing viewpoints.

Overconfidence Bias

Definition: Overconfidence bias is when investors overestimate their knowledge, abilities, or the accuracy of their predictions.

Example: An investor who has experienced success in a few trades may become overconfident and take on excessive risk, believing they can consistently beat the market.

Impact on the Market:

Overconfidence can lead to speculative bubbles, as investors take on more risk than is justified by market fundamentals.

Advantage: Recognizing overconfidence can help investors avoid unnecessary risks and make more calculated decisions.

Disadvantage: Overconfidence is difficult to identify in oneself, leading to potentially costly mistakes.

Loss Aversion

Definition: Loss aversion refers to the tendency to prefer avoiding losses over acquiring equivalent gains.

Example: An investor may hold onto a losing stock for too long, hoping to avoid realizing a loss, even when selling would be the more rational decision.

Impact on the Market:

Loss aversion can result in market inefficiencies, as investors make decisions based on emotions rather than logic.

Advantage: Understanding loss aversion can help investors make more objective decisions, such as cutting losses when necessary.

Disadvantage: The emotional pain of realizing a loss can be challenging to overcome, leading to suboptimal investment choices.

Anchoring Bias

Definition: Anchoring bias occurs when investors rely too heavily on an initial piece of information (the “anchor”) when making decisions.

Example: If a stock was once valued at $100 per share, an investor might anchor on that price, considering it the stock’s true value, even if market conditions have changed.

Impact on the Market:

Anchoring can lead to missed opportunities or holding onto losing investments due to an unrealistic reference point.

Advantage: Being aware of anchoring can help investors reassess their decisions based on current information, rather than outdated data.

Disadvantage: Anchoring is a deeply ingrained cognitive bias that can be difficult to overcome without conscious effort.

Recency Bias

Definition: Recency bias is the tendency to give more weight to recent events or experiences when evaluating a situation.

Example: After a market crash, an investor might assume that further declines are imminent, even if the long-term outlook remains positive.

Impact on the Market

: Recency bias can lead to overreaction in the market, causing excessive buying or selling based on short-term trends.

Advantage: Recognizing recency bias can help investors maintain a long-term perspective and avoid making impulsive decisions.

Disadvantage: The strong emotional impact of recent events can make it difficult to maintain an objective view of the market.

Advantages of Understanding Stock Market Psychology

Better Decision-Making

Understanding the psychological factors at play in the stock market can lead to more informed and rational decision-making. By recognizing biases and emotions that influence behavior, investors can avoid common pitfalls and make choices based on sound analysis rather than impulse.

Improved Risk Management

Awareness of psychological biases can enhance risk management strategies. For example, understanding the impact of overconfidence can help investors avoid taking on excessive risk, while recognizing loss aversion can prevent them from holding onto losing investments for too long.

Identification of Market Trends

Investors who understand the psychology behind stock market movements are better equipped to identify trends and potential turning points. By observing shifts in investor sentiment and behavior, they can anticipate changes in market direction and adjust their strategies accordingly.

Increased Resilience During Market Volatility

Market volatility can trigger fear and panic among investors, leading to hasty decisions. A solid understanding of market psychology can help investors remain calm and focused during turbulent times, enabling them to stay the course and avoid costly mistakes.

Enhanced Long-Term Performance

By incorporating psychological insights into their investment strategies, investors can improve their long-term performance. A balanced approach that accounts for both fundamental analysis and behavioral factors can lead to more consistent and successful outcomes over time.

Disadvantages of Relying on Stock Market Psychology

Potential for Overanalysis

While understanding psychology is beneficial, there is a risk of overanalyzing market behavior. Investors who focus too much on psychological factors may become paralyzed by indecision or overcomplicate their strategies, leading to missed opportunities.

Subjectivity and Uncertainty

Psychological factors are inherently subjective and can vary widely among individuals. This variability makes it challenging to predict market movements with precision based solely on psychological insights. As a result, relying too heavily on psychology may lead to inaccurate predictions and suboptimal decisions.

Difficulty in Quantification

Unlike financial metrics, psychological factors are difficult to quantify. This lack of concrete data can make it challenging for investors to integrate psychological insights into their investment models effectively. Without clear metrics, it may be harder to measure the impact of psychology on market movements.

Overemphasis on Short-Term Behavior

Psychological factors often influence short-term market behavior, leading to volatility and fluctuations. However, focusing too much on these short-term movements can distract investors from the long-term fundamentals that drive sustained market growth.

The Risk of Emotional Investing

Ironically, an overemphasis on market psychology can lead to emotional investing—exactly what investors seek to avoid. By constantly considering the emotions of other market participants, investors may become overly reactive to market sentiment, leading to impulsive decisions.

Real-World Examples of Psychology Driving Market Movements

The Dot-Com Bubble (1997-2000)

The dot-com bubble of the late 1990s is a classic example of herd behavior and overconfidence driving market movements. As internet companies proliferated, investors became increasingly confident in the sector’s potential, leading to inflated stock prices. The bubble burst in 2000, resulting in significant losses for many investors who had followed the herd.

The 2008 Financial Crisis

The 2008 financial crisis demonstrated the impact of fear and loss aversion on the stock market. As the housing market collapsed, panic spread, leading to widespread selling and a sharp decline in stock prices. Fear-driven decisions exacerbated the crisis, causing further market turmoil.

The COVID-19 Pandemic (2020)

The COVID-19 pandemic in 2020 highlighted the role of recency bias and emotional investing in stock market movements. Initially, the market experienced a sharp decline as investors feared the economic impact of the pandemic. However, as governments and central banks implemented stimulus measures, investor sentiment shifted, leading to a rapid recovery in stock prices.

Conclusion

The psychology behind stock market movements is a complex and fascinating subject that offers valuable insights for investors. By understanding the psychological biases and emotions that drive market behavior, investors can make more informed decisions, improve their risk management strategies, and enhance their long-term performance. However, it is essential to strike a balance between psychological insights and fundamental analysis to avoid the pitfalls of overanalysis and emotional investing. Ultimately, a well-rounded approach that considers both psychological and financial factors is key to navigating the ever-changing landscape of the stock market.

FAQs

- What is behavioral finance?

Behavioral finance is the study of how psychological factors influence financial decision-making and market behavior. It explores how emotions, biases, and cognitive errors impact investors and lead to deviations from rational financial models.

- How do emotions like fear and greed affect the stock market?

Fear and greed are powerful emotions that drive investor behavior. Greed can lead to excessive risk-taking and inflated stock prices, while fear can result in panic selling and sharp declines in the market.

- Can understanding psychology help me become a better investor?

Yes, understanding psychology can improve your investment decisions by helping you recognize and avoid common biases, manage risk more effectively, and anticipate market trends based on investor sentiment.

- What is herd behavior in the stock market?

Herd behavior occurs when investors follow the actions of the majority rather than making independent decisions. This can lead to market bubbles and crashes as prices become disconnected from fundamental values.

- How can I avoid emotional investing?

To avoid emotional investing, it is essential to develop a well-thought-out investment strategy based on research and analysis. Staying disciplined, maintaining a long-term perspective, and being aware of your emotions can help you make more rational decisions.

1 comment