Polycab India Q2 Results: Net Profit Rises 3.6% YoY to ₹445 Crore

Contents

Polycab India Q2 results

Polycab India Q2 Results: Net Profit Rises 3.6% YoY to ₹445 Crore

Key Financial Highlights (Q2 FY2024):

- Net Profit: Polycab India reported a 3.5% increase in consolidated net profit, rising to ₹445 crore in the quarter ending September 2024, compared to ₹429.77 crore in the same period of 2023.

- Revenue: Total income grew by 30% YoY to ₹5,574.6 crore, up from ₹4,253 crore a year ago, making it the highest-ever revenue recorded for Q2 by the company.

- Expenses: The company’s expenses rose to ₹4,984 crore, up from ₹3,695.9 crore in the same period last year, reflecting increased operational costs due to growth.

- FMEG Segment: The Fast-Moving Electrical Goods (FMEG) segment recorded an 18% YoY growth, supported by channel expansion, product enhancements, and influencer management initiatives.

Growth Drivers:

- Robust Government and Private Investments: The company attributed its growth to increased government spending, ongoing investments by private sector players, and strong demand in the real estate sector.

- Operational Efficiency: Polycab’s focus on operational excellence has helped them maintain steady growth amidst rising costs.

CEO Statement:

Inder T. Jaisinghani, Chairman and Managing Director of Polycab India, emphasized that the company is well-positioned to leverage emerging opportunities due to strong demand and a solid business strategy.

Advantages of Polycab India Q2 Performance:

- Revenue Growth: The company achieved 30% YoY growth in revenue, driven by strong demand across various business segments.

- Stable Profitability: Despite rising expenses, Polycab managed to report a 3.5% growth in net profit, reflecting solid financial management.

- Diversified Business: Growth in the FMEG segment by 18% highlights Polycab’s ability to expand its footprint in diverse product lines.

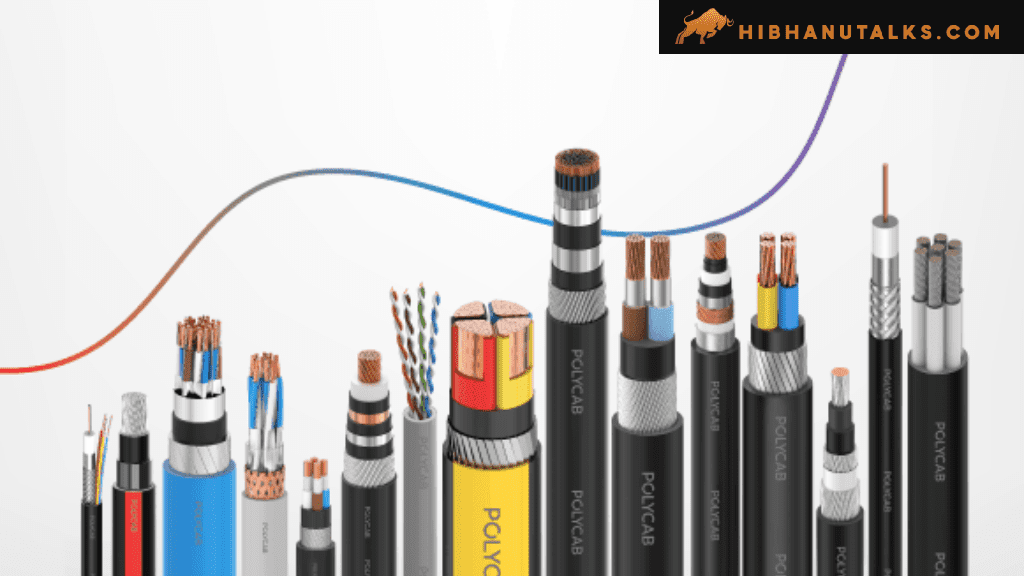

- Market Leadership: Polycab’s wires and cables division continues to dominate the market, contributing to the company’s overall robust performance.

- Long-Term Prospects: Increased spending from government and private sectors ensures a promising outlook for sustained growth.

Disadvantages of Polycab India Q2 Performance:

- Rising Expenses: Operating expenses jumped significantly by over ₹1,288 crore YoY, which may impact future profit margins if not controlled.

- Dependency on External Factors: Much of Polycab’s growth is dependent on government and real estate sector investments, making them vulnerable to policy changes or economic slowdowns.

- Slower Profit Growth: Despite robust revenue growth, profit only increased by 3.5%, which might indicate challenges in maintaining profitability at higher scales.

Conclusion:

Polycab India has demonstrated impressive revenue growth in Q2 2024, registering its highest-ever second-quarter revenue of ₹5,574.6 crore, which is a 30% YoY increase. The company’s strategic focus on operational efficiency and expanding its presence in the FMEG segment has contributed to this growth. Despite rising costs, Polycab continues to showcase resilience and steady financial performance. The future looks promising due to government investments and private sector involvement, though maintaining profitability amidst rising expenses will be crucial for continued success.

FAQs:

- What was Polycab India’s net profit for Q2 FY2024? Polycab India reported a net profit of ₹445 crore, up 5% YoY from ₹429.77 crore in Q2 FY2023.

- How much did Polycab’s revenue grow in Q2 FY2024? Polycab India’s revenue grew by 30% YoY, reaching ₹5,574.6 crore, compared to ₹4,253 crore in the same period last year.

- What contributed to Polycab’s growth in the FMEG segment? The FMEG segment grew by 18% YoY due to channel expansion, product improvements, and effective influencer management.

- Why did Polycab India’s expenses rise during Q2 FY2024? The company’s expenses rose to ₹4,984 crore, driven by increased operational costs associated with their revenue growth and expansion.

- What are the growth prospects for Polycab India? Polycab expects growth momentum to continue, fueled by government spending, private investments, and strong demand in the real estate sector. They are positioned to capitalize on these opportunities with a focus on operational excellence.

Polycab India Q2 results

Mphasis Reports Strong Q2 Performance with 8% Profit Growth Amid Revenue Challenges

Post Comment